How Many Business Loans Can I Get?

Theory shows that there is no actual limit on how many small business loans a borrower can take out, as long as they remain within the guidelines. There are often cases where rapidly growing companies have taken out up to nine loans within a 15-year span.

However, being approved for these loans is another subject. In order to do that, you need to provide a lot of information (and possibly collateral) to prove that you can return the loans on time.

Why is it better to look for business loans online?

Searching for the best business loans online lets you find information easily and compare the fees and other requirements offered by online lenders. Speaking of, these lenders emerged over the past decade and seized the opportunity to assist many small businesses with their straightforward approach on loans.

In times when the number of banks offering lend amounts under $250,000 is limited, most small business owners look online for their corporate financing needs. Online lenders make applying for a loan easy, require little documentation and are known for their fast approval.

Applying is free and will not affect your credit score.

Contact Us

What are some of the basic small business loan requirements?

If you decide to qualify for a small business loan, you may take some time to review your decision and consult with an expert in the field. But even before that, you might want to understand the basic qualification requirements that you will need to make the process easier.

Here, some of the most important steps you need to take are:

- Build personal and business credit - The better credit score you have, the easier it would be for you to qualify for a small business loan in Murfreesboro.

- Write a business plan - Your business plan will be used by the lender, who will assess risk and measure your probability of repaying it.

- Put up collateral - Putting forward collateral is a good practice. The higher its value is, the less risk you will pose to potential lenders.

- Choose the right option for you - It is important to choose the right loan and the right lender for your business, which is why many advise on talking to a loan advisor before making any moves.

- Gather documentation - Qualifying for a loan puts you up against plenty of documents, which usually start from your personal identification documents, business formation documents, bank statements, etc.

- Apply for the loan - Applying for a loan can be done online, which is a good alternative compared to traditional business financing options. You fill out an application, answer some basic questions, and submit your documents.

What is the difference between a secured and an unsecured business loan?

It’s actually simple – secured loans use assets as collateral. For instance, if you are starting a business, you can put up a lien against your house or equipment, to secure the loan that you are initiating. Generally speaking, secured loans are more favorable because the lenders take on less risk than with unsecured ones. Taking the risk yourself is in many cases enough to convince lenders or investors to jump and, and is a good way of getting your business going faster.

Unsecured loans are loans with no collateral. They are riskier for a lender, which is why they charge more with interest fees and other fees. If a lender sees too much risk with a loan, they won’t get involved. Still, unsecured loans are a great option for entrepreneurs in many cases – mostly because they do not require putting up anything from your livelihood or financials at direct risk.

Should I choose a business line of credit or a business term loan?

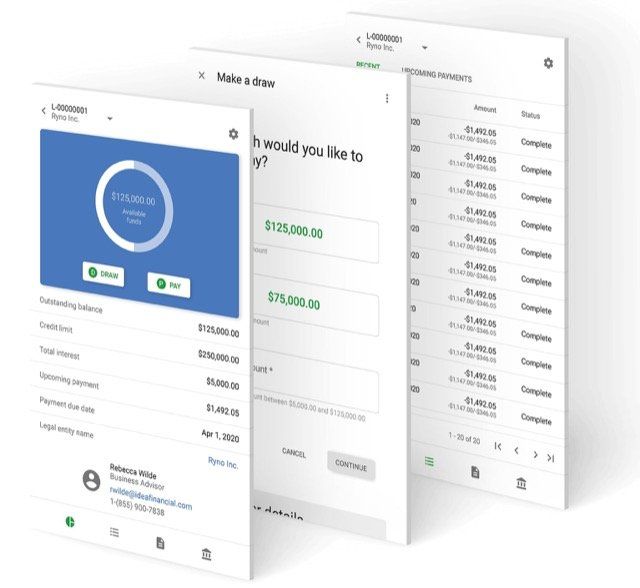

A business line of credit works very similarly to a credit card – it is a flexible loan that allows you to only pay interest on the portion of money that you borrow. You can repay your funds as you need, as long as you don’t exceed your credit limits. As such, it is a flexible option that allows you to manage your business’ cash flow and reuse or repay your credit whenever you need.

On the other hand, business term loans give you a lump sum of capital that you can pay back regularly. The good thing is that there is a fixed interest rate for a set period of time (around 1 to 5 years in most cases).

So, your choice should mostly be based around these differences and your unique needs.

How to make sure your small business loan gets approved?

Getting approved for your small business loan is mostly difficult, but not achievable. To make sure your chances of receiving a business loan are good, you will need to two things:

- Improve your credit score: Not every loan requires an extensive credit check, but many of them do. The best way to get approved for a business loan is by improving your credit score. Bad credit makes it harder to secure your loan, and makes borrowing money more expensive when you finally reach that point. So, make sure your business is registered within a credit reporting agency.

- Provide a personal financial summary: Prepare your documentation that includes all of your personal financials, such as assets that might be used for collateral (real estate, vehicles, investments, etc.). Also, make sure that all of the information provided is accurate, including your mortgages, loans, and credit card debt.

Getting approved for a small business loan can take some time. However, with online lenders, you can kick start the application process easily and get an answer within a couple of days.

Are loans a good way to grow your business?

There are a lot of factors that account for whether you should take out a loan or not. If you are feeling overwhelmed by your debt and need more answers, you can always speak to some of our advisors at Business Loans Murfreesboro. We will provide free advice to help you find ways to manage your money, get out of debt, and grow your business.

The bottom line is that at some point down the line, almost every business requires more money. Whether that money is needed for the business to expand, hire more staff, relocate, or invest in new equipment, the injection of cash is always welcome and is often one of the ways business owners increase revenue.