How to use a business line of credit?

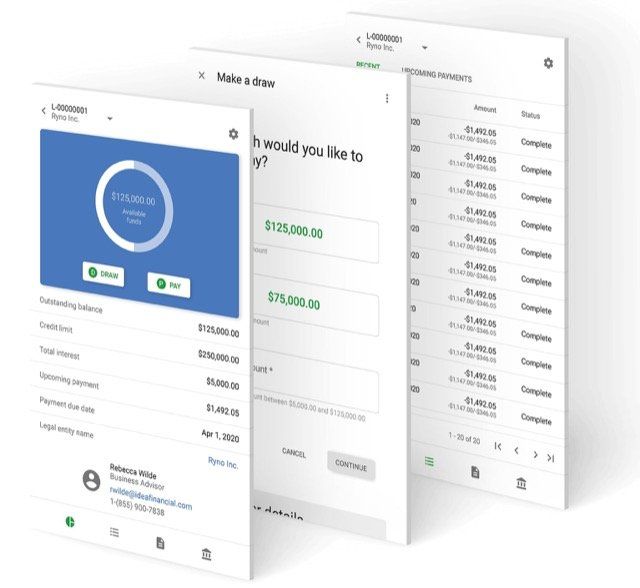

A business line of credit is a way to obtain financing without putting up collateral or any deposit. Such a method of financing is different from business loans. The advantage of a business line of credit is that it is faster, easier to get, requires less paperwork and the borrower can use these funds often.

This sounds too good, there must be a catch. The catch is that the amount that a business can borrow under a

business line of credit has a cap to $100k and it comes with variable interest. There are also specific requirements that each lender must qualify for this type of credit, such as good credit and the business must have had the same ownership for a specific amount of time.

The idea is that since this type of financing, since there is no deposit or collateral, then the borrower must prove via other means that it can repay the borrowed amounts. This type of financing is more like a personal credit card, where there is a limit and you pay the amount used at the end of the month, with the applicable interest. Understanding how a business line of credit works will help us to better use it.

Applying is free and will not affect your credit score.

Contact Us

Since the amount of borrowed funds is not large, compared to term loans and other business loan financing methods, then a business line of credit is better suited for small expenses and covering operations. A business line of credit does not allow access to large amounts of funds, so businesses in Murfreesboro can use the line of credit to cover short-term liabilities. By short-term liabilities, we mean payroll, supplies, inventory financing, and overall fast working capital. Murfreesboro businesses that operate in the consumer cyclical sectors can also use the line of credit to stabilize their cash flow during low season and buy time until their revenue grows big when their season is up.

There is also an interesting application of the business line of credits. Murfreesboro businesses can use this type of credit to improve their credit rating. Even if it might happen that the business does not need the funds, it can use the line of credit to build a better profile and to be a more credible borrower. This is important, as when the business will need to apply for loan terms and other forms of financing, then it will be able to negotiate a lower interest rate as the credit score will be high. Paying the monthly statements on time or even earlier will supercharge the business credit score and your Murfreesboro business will be able to get access to larger amounts of funding in the future.

In the worst-case scenario, the business line of credit can be used for larger purchases. In such a case, the business would be forced to open multiple lines of credit. This is a last-resource option as it is applicable when you need large amounts of financing, but you do not have access to a business loan term or a revolving line of credit.